Coronavirus: What is a recession and how could it affect me?

Page 1 of 1

Coronavirus: What is a recession and how could it affect me?

Coronavirus: What is a recession and how could it affect me?

Why does a recession matter?

For most people, economic growth is good.

It usually means there are more jobs, and companies are more profitable and can pay employees and shareholders more.

A growing economy also gives the government more money in taxes. So it can cut taxes, or spend more on benefits, public services and government workers' wages.

When the economy shrinks, all these things go into reverse.

So are the good times back?

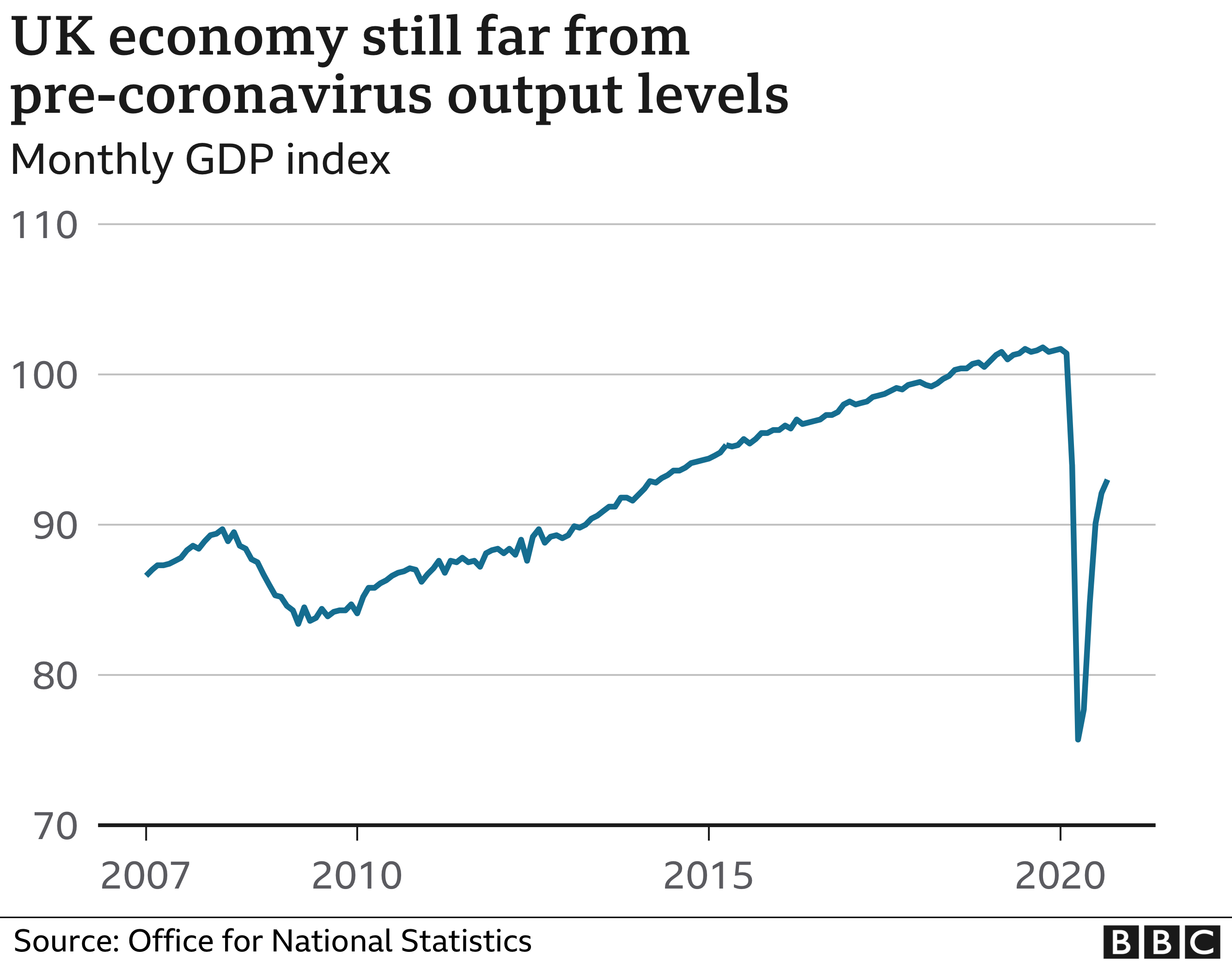

The third quarter of 2020 saw the UK economy growing again, meaning that technically the recession was over.

July to September saw the fastest three-month growth on record - 15.5% - which would be extraordinary in normal times.

But what the figures capture is an economy shutting down and reopening again. Shops and restaurants closed in the spring during the nationwide shutdown, and reopened in the summer.

People started going out, taking holidays and getting back to some of their normal lives. They spent more money, bringing the amount of economic activity closer to where it was last year.

However there is still a big gap between how the economy was doing last year, and where it stands today. Though the recession is over, the economy is 9.7% smaller than it was before the pandemic.

That reflects the fact that hundreds of thousands of people have lost their jobs, and millions are still on furlough, with the government paying most of their wages.

Many businesses still have far less trade than before the pandemic.

[size=11]image captionEconomic output fell sharply in the spring, and it has bounced back, but not all the way[/size]

Are we going back into recession?

It takes a while for statisticians to calculate the size of the economy, so their figures always describe the recent past, not what's happening today.

The latest figures run to the end of September, before wide-ranging new lockdowns were introduced around the UK.

However, the recovery's pace was already slowing down in September.

When figures for the October to December quarter are published, they may well show GDP falling again as England's nationwide lockdown and measures in other nations hit the economy.

If the following quarter also sees a fall, then that would be a second recession, or what is sometimes called a "double-dip" recession, where two recessions happen close together.

However, Bank of England forecasts expect to see growth next year. And if an effective vaccine becomes widely available, that would strongly boost the recovery.

What is happening around the world?

The UK has been doing worse than other major worldwide economies. The UK economy is 9.7% smaller than it was before the crisis began, but the US is only 3.5% smaller. France is 4.1% down, Germany is 4.2% down, and Spain is 9.1% down.

The UK's poor performance compared with other countries is partly down to a longer lockdown, experts believe.

The world economy will shrink by 4.4% in total this year, according to International Monetary Fund forecasts. This is less bad than the Fund expected three months ago, as the recession was less severe than they expected.

IMAGE COPYRIGHTGETTY IMAGES

IMAGE COPYRIGHTGETTY IMAGES[size=11]image captionThe US and other major economies have seen less deep recessions than the UK[/size]

How could a recession affect me?

Some people may lose their jobs, or find it harder to get promotions, or a pay rise.

Graduates and school leavers could find a first job harder to get.

However, the pain of a recession is typically not felt equally across society, and inequality can increase.

For instance, many UK homeowners who kept their jobs during the last recession did OK. Mortgage interest payments for many fell considerably, leaving them with more spending money.

Others, such as benefit recipients or public sector workers, did less well.

How long was the last recession?

In the UK, the last recession, caused by the global financial crisis, lasted five quarters - from the second quarter of 2008 onwards.

GDP fell by an estimated 7.2% over the whole period.

Unemployment rose sharply, but began to fall back again two years later.

And there was a massive deficit - the gap between what the government raises in taxes and what it spends on public services.

This resulted in a near-doubling of the national debt, and a decade-long programme of austerity. There were steep cuts in many areas of government spending, except health, education and international aid.

The 2020 recession has caused the government to run an even bigger deficit, and national debt has also grown rapidly during the period.

What can be done?

An effective vaccine would give the recovery the biggest possible boost.

In the meantime, the UK government and others around the world are borrowing huge sums to pay for schemes to protect jobs, support businesses and combat the virus.

The Bank of England is also supporting the economy by through quantitative easing, where it tries to encourage individuals and businesses to invest and spend more by buying government bonds.

https://www.bbc.com/news/business-52986863

Guest- Guest

Re: Coronavirus: What is a recession and how could it affect me?

Re: Coronavirus: What is a recession and how could it affect me?

svak je individualac. lakše je igrati igricu kada je težina easy(recimo njemačka/usa sa ekonomskim rastom).. U RH je igrica kada je ekonomski rast - medium.. sada smo na hard težini neko vrijeme...

_________________

May Allah destroy Australia

AssadNaPodmornici- Posts : 22332

2018-06-14

Re: Coronavirus: What is a recession and how could it affect me?

Re: Coronavirus: What is a recession and how could it affect me?

VIJEST PRIJE GODINU DANA NAJAVLJUJE OVU KRIZU...

The novel coronavirus has spurred what will likely be the worst recession in generations as the U.S. economy grinds to a halt and millions lose their jobs.

[size=156]100%

[/size]

Bloomberg Economics created a model last year to determine America’s recession odds. The chance of a recession now stands at 100%, confirming an end to the nation’s longest-running expansion.

While much of the economic data that feed into the model continues to lag, filings for unemployment benefits — which are reported with less than a week’s delay — saw an unprecedented increase at the end of March. About 10 million jobless claims were filed in the last two weeks of the month, underscoring a sharp deterioration in the once-vibrant labor market.

Probability of U.S. recession within 12 months

Source: Bloomberg Economics

The recession probability model developed by Bloomberg economists Eliza Winger, Yelena Shulyatyeva, Andrew Husby and Carl Riccadonna incorporates a range of data spanning economic conditions, financial markets and gauges of underlying stress.

The surge in the recession probability mainly reflects the shocking jobless claims figures, but plummeting stock prices for much of the month also played a role. The model's reading on the odds for February came in at 33%. At the time of the prior report, Bloomberg Economics took account of early financial market data for March, putting the odds at 53%.

Selected key indicators from recession probability model

Note: An Employment Diffusion Index lower than 50 means more industries are reducing employment than increasing employment

Sources: Labor Department, Bloomberg Economics

America looks starkly different from just a month ago. More than 11,000 in the country have died from Covid-19, while the number of infected was approaching 400,000 on Tuesday, the highest reported total worldwide. Social gatherings have been curbed and a majority of Americans have been directed to stay home. Restaurants, hotels, factories and a variety of other businesses have closed their doors.

The sudden stop in activity has many forecasters predicting the economy will experience its largest-ever contraction in the second quarter, and some analysts project about 20 million people will have lost their jobs by July.

Americans are increasingly pessimistic about the outlook, with one measure of consumer sentiment plunging last month by the most since October 2008. The March jobs report showed employers cut a net 701,000 jobs in the month, the most since the Great Recession — and a number that reflected just the first half of the month.

Normally, an increase in weekly filings for unemployment benefits is one of the indicators economists look to first for signs the U.S. is on the cusp of a recession. This time, they surged at such a rapid pace that they offered little advance notice that the economy was hurtling toward and into a downturn.

The Federal Reserve has taken dramatic steps to soften the economic hit. The central bank lowered the benchmark interest rate to near zero last month and has said it will buy unlimited amounts of Treasury bonds and mortgage-backed securities to keep markets functioning and borrowing costs low.

The government has also taken swift action. President Donald Trump last month signed the largest relief package in U.S. history, which provides approximately $2 trillion in support. The law includes direct payments for many Americans and financial help for small businesses, though it’s unclear if the aid will arrive fast enough for some.

Federal Reserve interest rate cuts in prior downturns

*Assumes minimum target range for the federal funds rate of 0-0.25%. Years denote start of easing cycles

Source: Bloomberg Economics

Many define a recession as two consecutive quarters of negative growth. The official dating committee at the National Bureau of Economic Research takes a more holistic approach, defining a recession as a “significant decline in economic activity spread across the economy, lasting more than a few months.”

The panel usually takes about six to 12 months to make the call, though, so the existence of a recession could be widely accepted before it’s official. As the chart below shows, not all recessions are created equal. The 2007-2009 downturn was especially protracted and deep because it coincided with a financial crisis. Other recessions have been shorter and shallower.

Quarterly change in U.S. GDP following recession; 100 = start of recession

Sources: BEA, Bloomberg Economics

Recessions are usually accompanied by a swift increase in the unemployment rate. The jobless rate differs greatly between downturns depending on the breadth and severity of the recession. While unemployment peaked at 10% in 2009, and rose even higher in the early 1980s, other downturns have brought still-painful but smaller increases in the jobless rate. Many economists predict the unemployment rate will jump into the mid-teens or higher in the coming months, as millions of Americans join the ranks of the unemployed.

Quarterly change in U.S. unemployment rate in past recessions

Sources: BLS, Bloomberg Economics

Source: Bloomberg Economics

[size=52]U.S. Recession Model at 100% Confirms Downturn Is Already Here[/size]

By Reade Pickert, Yue Qiu and Alexander McIntyre

Published: October 14, 2019, 11:00 AM | Updated: April 8, 2020, 11:00 AM

Published: October 14, 2019, 11:00 AM | Updated: April 8, 2020, 11:00 AM

- [url=https://twitter.com/share?text=U.S. Recession Model at 100% Confirms Downturn Is Already here&via=business&url=][/url]

[url=https://twitter.com/share?text=U.S. Recession Model at 100% Confirms Downturn Is Already here&via=business&url=][/url] - [url=https://www.linkedin.com/shareArticle?mini=true&title=U.S. Recession Model at 100% Confirms Downturn Is Already here&summary=&url=][/url]

[url=https://www.linkedin.com/shareArticle?mini=true&title=U.S. Recession Model at 100% Confirms Downturn Is Already here&summary=&url=][/url]

The novel coronavirus has spurred what will likely be the worst recession in generations as the U.S. economy grinds to a halt and millions lose their jobs.

[size=156]100%

[/size]

Chance of Recession Within 12 Months

Bloomberg Economics created a model last year to determine America’s recession odds. The chance of a recession now stands at 100%, confirming an end to the nation’s longest-running expansion.

Now that the recession has arrived, sign up to receive weekly updates to our Recovery Tracker

While much of the economic data that feed into the model continues to lag, filings for unemployment benefits — which are reported with less than a week’s delay — saw an unprecedented increase at the end of March. About 10 million jobless claims were filed in the last two weeks of the month, underscoring a sharp deterioration in the once-vibrant labor market.

Recession is Here

Probability of U.S. recession within 12 months

Source: Bloomberg Economics

The recession probability model developed by Bloomberg economists Eliza Winger, Yelena Shulyatyeva, Andrew Husby and Carl Riccadonna incorporates a range of data spanning economic conditions, financial markets and gauges of underlying stress.

The surge in the recession probability mainly reflects the shocking jobless claims figures, but plummeting stock prices for much of the month also played a role. The model's reading on the odds for February came in at 33%. At the time of the prior report, Bloomberg Economics took account of early financial market data for March, putting the odds at 53%.

Unemployment Soars, Stocks Plummet

Selected key indicators from recession probability model

Note: An Employment Diffusion Index lower than 50 means more industries are reducing employment than increasing employment

Sources: Labor Department, Bloomberg Economics

America looks starkly different from just a month ago. More than 11,000 in the country have died from Covid-19, while the number of infected was approaching 400,000 on Tuesday, the highest reported total worldwide. Social gatherings have been curbed and a majority of Americans have been directed to stay home. Restaurants, hotels, factories and a variety of other businesses have closed their doors.

The sudden stop in activity has many forecasters predicting the economy will experience its largest-ever contraction in the second quarter, and some analysts project about 20 million people will have lost their jobs by July.

Americans are increasingly pessimistic about the outlook, with one measure of consumer sentiment plunging last month by the most since October 2008. The March jobs report showed employers cut a net 701,000 jobs in the month, the most since the Great Recession — and a number that reflected just the first half of the month.

Normally, an increase in weekly filings for unemployment benefits is one of the indicators economists look to first for signs the U.S. is on the cusp of a recession. This time, they surged at such a rapid pace that they offered little advance notice that the economy was hurtling toward and into a downturn.

The Federal Reserve has taken dramatic steps to soften the economic hit. The central bank lowered the benchmark interest rate to near zero last month and has said it will buy unlimited amounts of Treasury bonds and mortgage-backed securities to keep markets functioning and borrowing costs low.

The government has also taken swift action. President Donald Trump last month signed the largest relief package in U.S. history, which provides approximately $2 trillion in support. The law includes direct payments for many Americans and financial help for small businesses, though it’s unclear if the aid will arrive fast enough for some.

Zero-Bound

Federal Reserve interest rate cuts in prior downturns

*Assumes minimum target range for the federal funds rate of 0-0.25%. Years denote start of easing cycles

Source: Bloomberg Economics

Many define a recession as two consecutive quarters of negative growth. The official dating committee at the National Bureau of Economic Research takes a more holistic approach, defining a recession as a “significant decline in economic activity spread across the economy, lasting more than a few months.”

The panel usually takes about six to 12 months to make the call, though, so the existence of a recession could be widely accepted before it’s official. As the chart below shows, not all recessions are created equal. The 2007-2009 downturn was especially protracted and deep because it coincided with a financial crisis. Other recessions have been shorter and shallower.

Shallow or Deep?

Quarterly change in U.S. GDP following recession; 100 = start of recession

Sources: BEA, Bloomberg Economics

Recessions are usually accompanied by a swift increase in the unemployment rate. The jobless rate differs greatly between downturns depending on the breadth and severity of the recession. While unemployment peaked at 10% in 2009, and rose even higher in the early 1980s, other downturns have brought still-painful but smaller increases in the jobless rate. Many economists predict the unemployment rate will jump into the mid-teens or higher in the coming months, as millions of Americans join the ranks of the unemployed.

Out of Work

Quarterly change in U.S. unemployment rate in past recessions

Sources: BLS, Bloomberg Economics

Source: Bloomberg Economics

Guest- Guest

Re: Coronavirus: What is a recession and how could it affect me?

Re: Coronavirus: What is a recession and how could it affect me?

https://www.bloomberg.com/graphics/us-economic-recession-tracker/

Guest- Guest

Re: Coronavirus: What is a recession and how could it affect me?

Re: Coronavirus: What is a recession and how could it affect me?

AssadNaPodmornici wrote:svak je individualac. lakše je igrati igricu kada je težina easy(recimo njemačka/usa sa ekonomskim rastom).. U RH je igrica kada je ekonomski rast - medium.. sada smo na hard težini neko vrijeme...

ajd malo prokopaj ovo,pa napisi stogod..ipak si ti ekonomist..daj forumasima neki savjet..

Guest- Guest

Re: Coronavirus: What is a recession and how could it affect me?

Re: Coronavirus: What is a recession and how could it affect me?

malo u proslost...

Recession of 1937–1938

From Wikipedia, the free encyclopedia

Jump to navigationJump to search

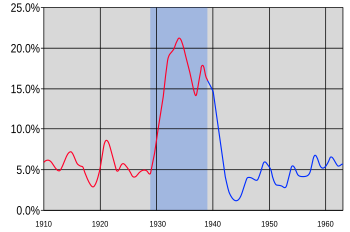

Unemployment rate in the US 1910–1960, with the years of the Great Depression (1929–1939) highlighted.

% U.S. Unemployment (estimated)

% U.S. Unemployment[size][ltr]

The recession of 1937–1938 was an economic downturn that occurred during the Great Depression in the United States.

By the spring of 1937, production, profits, and wages had regained their early 1929 levels. Unemployment remained high, but it was substantially lower than the 25% rate seen in 1933. The American economy took a sharp downturn in mid-1937, lasting for 13 months through most of 1938. Industrial production declined almost 30 percent, and production of durable goods fell even faster.

Unemployment jumped from 14.3% in May 1937 to 19.0% in June 1938.[1] Manufacturing output fell by 37% from the 1937 peak and was back to 1934 levels.[2] Producers reduced their expenditures on durable goods, and inventories declined, but personal income was only 15% lower than it had been at the peak in 1937. In most sectors, hourly earnings continued to rise throughout the recession, partly compensating for the reduction in the number of hours worked. As unemployment rose, consumer expenditures declined, leading to further cutbacks in production.[citation needed]

[/ltr][/size]

[size][ltr]

Manufacturing employment in the United States from 1920 to 1940.[size][ltr]

The Roosevelt Administration was under assault during Roosevelt's second term, which presided over a new dip in the Great Depression in the fall of 1937 that continued through most of 1938. Production and profits declined sharply. Unemployment jumped from 14.3% in 1937 to 19.0% in 1938. The downturn was perhaps due to nothing more than the familiar rhythms of the business cycle. But until 1937 Roosevelt had claimed responsibility for the excellent economic performance. That backfired in the recession and the heated political atmosphere of 1937.[3]

Business-oriented conservatives explained the recession by arguing that the New Deal had been very hostile to business expansion in 1935–1937, had threatened massive antitrust legal attacks on big corporations and by the huge strikes caused by the organizing activities of the Congress of Industrial Organizations (CIO) and the American Federation of Labor (AFL). The recovery was explained by the conservatives in terms of the diminishing of those threats sharply after 1938. For example, the antitrust efforts fizzled out without major cases. The CIO and AFL unions started battling each other more than corporations, and tax policy became more favorable to long-term growth.[4]

[/ltr][/size]

Scene in an agricultural worker's shack town, Oklahoma City, July 1939[size][ltr]

"When The Gallup Organization's poll in 1939 asked, 'Do you think the attitude of the Roosevelt administration toward business is delaying business recovery?' the American people responded 'yes' by a margin of more than two-to-one. The business community felt even more strongly so."[5] Fortune's Roper poll found in May 1939 that 39% of Americans thought the administration had been delaying recovery by undermining business confidence, while 37% thought it had not. But it also found that opinions on the issue were highly polarized by economic status and occupation. In addition, AIPO found in the same time that 57% believed that business attitudes toward the administration were delaying recovery, while 26% thought they were not, emphasizing that fairly subtle differences in wording can evoke substantially different polling responses.[6]

Keynesian economists stated that the recession of 1937 was a result of a premature effort to curb government spending and balance the budget.[7] Roosevelt had been cautious not to run large deficits. In 1937 he actually achieved a balanced budget. Therefore, he did not fully utilize deficit spending.[8] Between 1933 and 1941 the average federal budget deficit was 3% per year.[9]

In November 1937 Roosevelt decided that big businesses were trying to ruin the New Deal by causing another depression that voters would react against by voting Republican.[10] It was a "capital strike" said Roosevelt, and he ordered the Federal Bureau of Investigation to look for a criminal conspiracy (they found none). Roosevelt moved left and unleashed a rhetorical campaign against monopoly power, which was cast as the cause of the new crisis. United States Secretary of the Interior Harold L. Ickes attacked automaker Henry Ford, steelmaker Tom Girdler, and the super rich "Sixty Families" who supposedly comprised "the living center of the modern industrial oligarchy which dominates the United States".[11]

Left unchecked, Ickes warned, they would create "big-business Fascist America—an enslaved America". The President appointed Robert Jackson as the aggressive new director of the antitrust division of the Justice Department, but this effort lost its effectiveness once World War II began and big business was urgently needed to produce war supplies. But the Administration's other response to the 1937 dip that stalled recovery from the Great Depression had more tangible results.[12]

Ignoring the requests of the Treasury Department and responding to the urgings of the converts to Keynesian economics and others in his Administration, Roosevelt embarked on an antidote to the depression, reluctantly abandoning his efforts to balance the budget and launching a $5 billion spending program in the spring of 1938, an effort to increase mass purchasing power.[13] Roosevelt explained his program in a fireside chat in which he told the American people that it was up to the government to "create an economic upturn" by making "additions to the purchasing power of the nation".

Recession of 1937–1938

From Wikipedia, the free encyclopedia

Jump to navigationJump to search

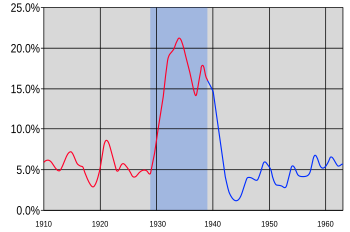

Unemployment rate in the US 1910–1960, with the years of the Great Depression (1929–1939) highlighted.

% U.S. Unemployment (estimated)

% U.S. Unemployment

The recession of 1937–1938 was an economic downturn that occurred during the Great Depression in the United States.

By the spring of 1937, production, profits, and wages had regained their early 1929 levels. Unemployment remained high, but it was substantially lower than the 25% rate seen in 1933. The American economy took a sharp downturn in mid-1937, lasting for 13 months through most of 1938. Industrial production declined almost 30 percent, and production of durable goods fell even faster.

Unemployment jumped from 14.3% in May 1937 to 19.0% in June 1938.[1] Manufacturing output fell by 37% from the 1937 peak and was back to 1934 levels.[2] Producers reduced their expenditures on durable goods, and inventories declined, but personal income was only 15% lower than it had been at the peak in 1937. In most sectors, hourly earnings continued to rise throughout the recession, partly compensating for the reduction in the number of hours worked. As unemployment rose, consumer expenditures declined, leading to further cutbacks in production.[citation needed]

[/ltr][/size]

[ltr]

Contents

[/ltr]- 1Recession of 1937 and recovery

- 2Rhetorical response

- 3Recovery

- 4Interpretations

- 5See also

- 6Notes

- 7Further reading

[size][ltr]

Recession of 1937 and recovery[edit]

[/ltr][/size]

Manufacturing employment in the United States from 1920 to 1940.

The Roosevelt Administration was under assault during Roosevelt's second term, which presided over a new dip in the Great Depression in the fall of 1937 that continued through most of 1938. Production and profits declined sharply. Unemployment jumped from 14.3% in 1937 to 19.0% in 1938. The downturn was perhaps due to nothing more than the familiar rhythms of the business cycle. But until 1937 Roosevelt had claimed responsibility for the excellent economic performance. That backfired in the recession and the heated political atmosphere of 1937.[3]

Business-oriented conservatives explained the recession by arguing that the New Deal had been very hostile to business expansion in 1935–1937, had threatened massive antitrust legal attacks on big corporations and by the huge strikes caused by the organizing activities of the Congress of Industrial Organizations (CIO) and the American Federation of Labor (AFL). The recovery was explained by the conservatives in terms of the diminishing of those threats sharply after 1938. For example, the antitrust efforts fizzled out without major cases. The CIO and AFL unions started battling each other more than corporations, and tax policy became more favorable to long-term growth.[4]

[/ltr][/size]

Scene in an agricultural worker's shack town, Oklahoma City, July 1939

"When The Gallup Organization's poll in 1939 asked, 'Do you think the attitude of the Roosevelt administration toward business is delaying business recovery?' the American people responded 'yes' by a margin of more than two-to-one. The business community felt even more strongly so."[5] Fortune's Roper poll found in May 1939 that 39% of Americans thought the administration had been delaying recovery by undermining business confidence, while 37% thought it had not. But it also found that opinions on the issue were highly polarized by economic status and occupation. In addition, AIPO found in the same time that 57% believed that business attitudes toward the administration were delaying recovery, while 26% thought they were not, emphasizing that fairly subtle differences in wording can evoke substantially different polling responses.[6]

Keynesian economists stated that the recession of 1937 was a result of a premature effort to curb government spending and balance the budget.[7] Roosevelt had been cautious not to run large deficits. In 1937 he actually achieved a balanced budget. Therefore, he did not fully utilize deficit spending.[8] Between 1933 and 1941 the average federal budget deficit was 3% per year.[9]

In November 1937 Roosevelt decided that big businesses were trying to ruin the New Deal by causing another depression that voters would react against by voting Republican.[10] It was a "capital strike" said Roosevelt, and he ordered the Federal Bureau of Investigation to look for a criminal conspiracy (they found none). Roosevelt moved left and unleashed a rhetorical campaign against monopoly power, which was cast as the cause of the new crisis. United States Secretary of the Interior Harold L. Ickes attacked automaker Henry Ford, steelmaker Tom Girdler, and the super rich "Sixty Families" who supposedly comprised "the living center of the modern industrial oligarchy which dominates the United States".[11]

Left unchecked, Ickes warned, they would create "big-business Fascist America—an enslaved America". The President appointed Robert Jackson as the aggressive new director of the antitrust division of the Justice Department, but this effort lost its effectiveness once World War II began and big business was urgently needed to produce war supplies. But the Administration's other response to the 1937 dip that stalled recovery from the Great Depression had more tangible results.[12]

Ignoring the requests of the Treasury Department and responding to the urgings of the converts to Keynesian economics and others in his Administration, Roosevelt embarked on an antidote to the depression, reluctantly abandoning his efforts to balance the budget and launching a $5 billion spending program in the spring of 1938, an effort to increase mass purchasing power.[13] Roosevelt explained his program in a fireside chat in which he told the American people that it was up to the government to "create an economic upturn" by making "additions to the purchasing power of the nation".

Rhetorical response[edit]

The Roosevelt Administration reacted by launching a rhetorical campaign against monopoly power, which was cast as the cause of the depression, and appointing Thurman Arnold in the antitrust division of the U.S. Department of Justice to act, but Arnold was not effective.[14] In February 1938, Congress passed a new AAA bill, the Agricultural Adjustment Act of 1938, which authorized crop loans, crop insurance against natural disasters, and large subsidies to farmers who cut back production. On April 2, Roosevelt sent a new large-scale spending program to Congress and received $3.75 billion, which was split among Public Works Administration (PWA), Works Progress Administration (WPA), and various relief agencies.[15] Other appropriations raised the total to $5 billion in the spring of 1938, after which the economy recovered.[/ltr][/size]

Guest- Guest

Re: Coronavirus: What is a recession and how could it affect me?

Re: Coronavirus: What is a recession and how could it affect me?

pa ne pratim više toliko ekonomiju , :D (prije sam čak i pisao blog a znali su ga objaviti neki portali ali to ima 4-5 godina sam prestao :D ) moj savjet je - odjebite RH državu, neće vam biti bolje, nije cilj Jadronkoviću ili Beljaku da vama bude bolje, njima je cilj da njima bude bolje i još bolje, a vama po mogućnosti taman dovoljno da mislite da ćete prateći njihova pravila postići nešto, a u stvarnosti ćete imati taman da malo plivate iznad nove i da se ne bunite po mogućnosti..Legendovich wrote:AssadNaPodmornici wrote:svak je individualac. lakše je igrati igricu kada je težina easy(recimo njemačka/usa sa ekonomskim rastom).. U RH je igrica kada je ekonomski rast - medium.. sada smo na hard težini neko vrijeme...

ajd malo prokopaj ovo,pa napisi stogod..ipak si ti ekonomist..daj forumasima neki savjet..

sve se svodi na individualnost, države su samo papir u novom svijetu.. i to komad papira koji je razočara građane.. i tako treba gledati.. imate onda dva izbora, da se zaključate u podrum kao ja i longi i isključite iz sustava, ili da učite nove vještine online, od jezika, administriranja, programiranja, marketinag, investiranja, sve to imate online tečajeve, idete raditi vanka, polažete kurseve za stvari koje su tražene na tržištu.. i gledate neki business, investiranje, remote/freelance poslove.. ništa vam država neće pomoći, onda je tu da održi domoljube/antifašiste na vrhu hranidbenog lanca a vi ste im hrana

pogledajte ovu ojebinu, ako mislite da ćete od ovakve ojebine dobiti nešto u životu.. pa ovakva ojebina je po inteligenciji, i poštenju, gora od vas sigurno. jedino što ona ima a to je lopovski/čardak mentalitet i da zna kome se uvaliti u šupak na vrijeme i gdje ukrasti.

_________________

May Allah destroy Australia

AssadNaPodmornici- Posts : 22332

2018-06-14

Re: Coronavirus: What is a recession and how could it affect me?

Re: Coronavirus: What is a recession and how could it affect me?

AssadNaPodmornici wrote:pa ne pratim više toliko ekonomiju , :D (prije sam čak i pisao blog a znali su ga objaviti neki portali ali to ima 4-5 godina sam prestao :D ) moj savjet je - odjebite RH državu, neće vam biti bolje, nije cilj Jadronkoviću ili Beljaku da vama bude bolje, njima je cilj da njima bude bolje i još bolje, a vama po mogućnosti taman dovoljno da mislite da ćete prateći njihova pravila postići nešto, a u stvarnosti ćete imati taman da malo plivate iznad nove i da se ne bunite po mogućnosti..Legendovich wrote:AssadNaPodmornici wrote:svak je individualac. lakše je igrati igricu kada je težina easy(recimo njemačka/usa sa ekonomskim rastom).. U RH je igrica kada je ekonomski rast - medium.. sada smo na hard težini neko vrijeme...

ajd malo prokopaj ovo,pa napisi stogod..ipak si ti ekonomist..daj forumasima neki savjet..

sve se svodi na individualnost, države su samo papir u novom svijetu.. i to komad papira koji je razočara građane.. i tako treba gledati.. imate onda dva izbora, da se zaključate u podrum kao ja i longi i isključite iz sustava, ili da učite nove vještine online, od jezika, administriranja, programiranja, marketinag, investiranja, sve to imate online tečajeve, idete raditi vanka, polažete kurseve za stvari koje su tražene na tržištu.. i gledate neki business, investiranje, remote/freelance poslove.. ništa vam država neće pomoći, onda je tu da održi domoljube/antifašiste na vrhu hranidbenog lanca a vi ste im hrana

pogledajte ovu ojebinu, ako mislite da ćete od ovakve ojebine dobiti nešto u životu.. pa ovakva ojebina je po inteligenciji, i poštenju, gora od vas sigurno. jedino što ona ima a to je lopovski/čardak mentalitet i da zna kome se uvaliti u šupak na vrijeme i gdje ukrasti.

a da..Šujica...To ona dubrovacka gradonacelnica,koja je jeftino uzela velike parcele oko dubrovnika,pa ih prenamjenila u gradjevinsko zemljiste...kapnulo joj 3-5 miljuna ojra u dzep u razlici cvijene..moze ona tapsati ovom hodajucem lesu,nema nju da boli glava..inace odlicno si tekst poslozio...davno sam se presaltao na filozofiju koju si napisao..zato i jesam josh prije 7 godina oso iz RH..

dvi kategorije driftera ce ostati(neovisno o bransi) oni koji mogu od doma raditi,i njihov rad da se cijeni i plati,ili najamnu radnu snagu,koja ce morati biti brzo mobilna..bolje onda od kuce..

Guest- Guest

Re: Coronavirus: What is a recession and how could it affect me?

Re: Coronavirus: What is a recession and how could it affect me?

malo budem kopao u dubinu,i stavljao tekstove,da napokon postanete svjesni cime se morate poceti baviti...

Guest- Guest

Re: Coronavirus: What is a recession and how could it affect me?

Re: Coronavirus: What is a recession and how could it affect me?

dollar stock index..

https://www.marketwatch.com/investing/index/DXY

https://www.marketwatch.com/investing/index/DXY

Guest- Guest

Similar topics

Similar topics» The Coronavirus Explained & What You Should Do

» Coronavirus News

» In Russia, 10,581 new cases of coronavirus were detected

» Stockholm No-Go Suburb Most Affected by Coronavirus

» There’s More Bad News on the Long-Term Effects of the Coronavirus

» Coronavirus News

» In Russia, 10,581 new cases of coronavirus were detected

» Stockholm No-Go Suburb Most Affected by Coronavirus

» There’s More Bad News on the Long-Term Effects of the Coronavirus

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum

Events

Events Latest images

Latest images

by Guest 29/11/2020, 10:11

by Guest 29/11/2020, 10:11